Executive Summary

- Last year Senators Elizabeth Warren (D-Mass.) and Tammy Baldwin (D-Wisc.) along with Rep. Jan Schakowsky (D-Ill.) introduced the Price Gouging Prevention Act of 2022 which would allow the Federal Trade Commission (FTC) and state Attorney Generals to enforce a federal ban against “unconscionably excessive” price gouging.

- While having good intentions, such legislation has dangerous economic repercussions if enacted that could prolong shortages.

- Lawmakers should address supply shortages by quantifying what “unconscionably excessive” price gouging is, cutting down on red tape, and fixing supply chain issues.

Introduction

The pandemic saw dramatic increases in the price of necessary supplies. From a pack of masks costing over $200 to Purell costing almost $150, prices for goods that people genuinely needed skyrocketed. Many politicians criticized suppliers and large corporations for using the chaos of global markets as a guise for artificially inflating prices to increase their bottom line, and this is partially true; however, politicians failed to fully account for the conditions leading to these price increases. A dramatic increase in demand without a proportionate increase in supply will ultimately lead to a shortage and price increases. Despite politicians’ many protests, however, this is not necessarily a bad thing.

The Efficiency Argument

Consumers who need a product more are generally willing to pay higher prices for that product. In cases where there is an extreme shortage of a good, the ability to pay higher prices ensures that people who value that good the most are able to receive it. Of course, this does have flaws (i.e., poorer people who need ice to keep insulin cool may lack the capital to compete with a millionaire who just wants to keep her drinks cool). However, this is not a fault of the market, but rather an issue of supply. While goods can be distributed in non-market ways (i.e., a lottery system), there will always be scenarios where people will be given goods they do not really need, and some people will be left out from receiving goods they do need. At least in a market-based system, all participants have the opportunity to take an active role in determining whether or not they receive a good. The question then comes to what is the most effective way to end the supply shortage.

Ending the Shortage

Not only does a market-based system generally allow people to receive the goods they value the most, but it also helps to end the shortage faster. A free market inherently also acts as a price system, conveying important information about what consumers are demanding. If market entities see that consumers are willing to pay four times the regular amount for a specific good, then producers have a larger incentive to produce that product. As supply increases, then prices will decrease— this process will repeat itself until the market is back at equilibrium.

Say a government decided to distribute gas generators by lottery instead of having them be sold on the market. Producers would not only lack the incentive to produce additional gas generators, but they would also lack the knowledge of just how much demand there is for these generators and may produce an inaccurate amount of supply.

Not to mention, if prices become too high for a good, consumers have the ability to simply not purchase that good. This forces producers to lower the price of the good to something more palatable to consumers. A market-based system that allows for price gouging is the most effective tool we have for ending the shortage. In other words, anti-gouging laws ensure scarcity.

Anti-gouging laws also promote the use of black markets to sell goods. If demand for a particular good is still high despite anti-gouging legislation, producers will simply sell their product on the black market. This allows citizens engaging in illicit activity to receive necessary goods that law-abiding citizens cannot. Black market economic activity has a variety of other negative ramifications like tax evasion.

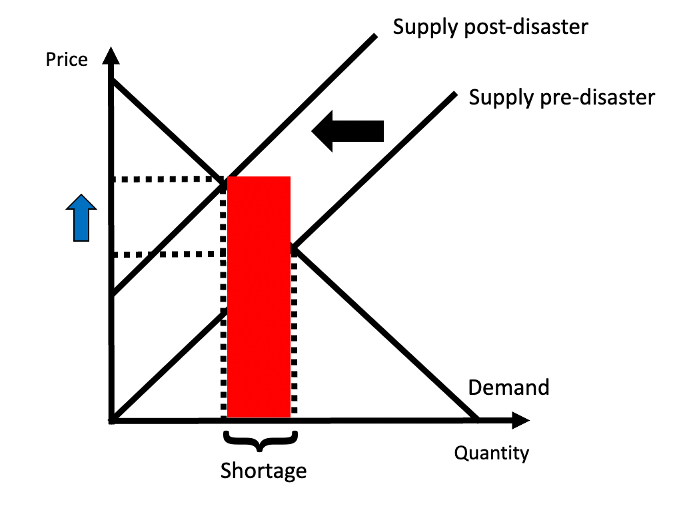

Politicians are concerned with addressing the price increase (see the blue arrow) of products following the contraction (leftward shift) of the supply curve. In reality, they should be addressing the shortage (see the red bar) created by the market shock. If the supply curve can return to the original market equilibrium, the shortage will end, prices will decrease, and consumers will be able to purchase the goods they want.

The Immorality of Anti-Gouging Laws

Michael Munger wrote an eye-opening essay that goes more in-depth on the ramifications of anti-price gouging legislation. The aspect I want to focus on specifically is the individuals who traveled to the hurricane-struck area where there was a shortage of ice. These individuals came with trucks fully stocked with bags of ice. They charged extremely high prices— causing outrage among the citizens and leading to their eventual arrest for violating anti-price gouging laws and the confiscation of their product. This product (ice) then proceeded to sit in a squad car where it melted, taking away what little ice was left in the area.

There are obviously a few problems with the scenario above. The most apparent being the spoiled supply of ice. Why would we have legislation that makes it harder for people to get the supplies they need? Why would we celebrate this legislation and push for it on a national level?

A large problem with anti-gouging legislation is that it fails to account for the increased risk these producers take on. In this specific example above, the men bringing ice to the affected area had to not only take on the risk of buying large quantities of ice but also had to transport it to the affected region, not an easy feat in the aftermath of a hurricane. Not only do price spikes act as a geographical incentive for producers to come to the affected area to sell goods, but they also act as a time incentive to encourage producers to sell goods now while prices are high.

If there is to be any anti-price gouging legislation, the legislation needs to have some mechanism to account for increased risk taken on by the producer as well as what the current market dictates what the price should be.

The Philosophical Questions

Anti-gouging legislation not only ignores the concepts of supply and demand and ensures scarcity, but it begs the question, does placing artificial limits on markets (anti-gouging legislation) actually prevent people’s freedom to pursue their conception of a good life? This is a more abstract, philosophical question and raises a larger debate about engaging in a free market and the American way of life, but it frames the issue from the perspective of a producer.

Is it un-American to prevent driven individuals from engaging in market transactions? Free market enterprise has solidified itself as a foundational aspect of American society. Something feels quite strange about preventing Americans from engaging in voluntary market transactions. This, in turn, begs the question, how can engaging in a market transaction that is voluntary be any worse than not engaging in any market transaction at all?

If a buyer and a seller voluntarily agree to the deals of a contract for a normal good, regardless of the price being charged for the good, why should the government have any say whatsoever as to whether or not the deal can go through? The answer is clear: they should not.

Conclusion

While anti-gouging regulations are grounded in the purpose of promoting fairness, they fundamentally ignore guiding market principles— occasionally leading to prolonged shortages and worse outcomes. While all people find exploitation repugnant, people’s immediate reaction of disgust against price gouging is often misled and completely ignores the goal of efficiently allocating scarce resources.

The problem is not price-gouging, it is the shortage. Anti-price gouging laws’ fundamental ignorance of market principles corrupts the price system, removing incentives and prolonging the shortage. This legislation can prevent motivated individuals who have the means to provide goods as they lack the incentive to make profits and could potentially face prison time.

Keep in mind that anti-gouging legislation is usually triggered by the declaration of a state of emergency. However, just because it is a time of disaster does not mean market principles do not apply.

Having established the flaws with anti-gouging legislation, there is some serious concern about the federal legislation pertaining to anti-gouging practices. Going forward, legislators should quantify what “unconscionably excessive” price gouging is. The lack of clarity in this kind of legislation is concerning and indicative of the lack of forethought about this type of legislation’s effects. Perhaps legislation could quantify what price gouging looks like by using a formula accounting for multiple variables including the good in question, the force behind the market shock, the number of people affected, etc.

Additionally, overburdensome regulations like licensing requirements, verification protocols, and reporting benchmarks can discourage out-of-state producers from attempting to engage in the market. Simplifying the regulatory process and removing some of the bureaucratic red tape may increase supply.

As it stands now, the conquest to eradicate exploitation in the market certainly has noble motivations, but providing the Federal Trade Commission $1 billion to investigate and hunt down price gougers is not the most efficient way of achieving that goal. Instead, that money could be used to create new distribution channels and tackle supply chain issues, because the problem is not price gouging, the problem is the shortage.

You must be logged in to post a comment.