Executive Summary

- If elected in 2024, Trump is proposing a 10% tariff on all U.S. imports.

- As a result, U.S. businesses would be faced with a substantial rise in import costs.

- Much of this would likely be paid by small and medium-sized enterprises (SMEs), who may end up taxed over $83.9 billion annually.

Introduction

If elected President in 2024, Donald Trump has vowed to continue implementing protectionist policies in The White House. When speaking to Fox News in August, Trump affirmed his desire to impose a 10% tariff on all U.S. imports. The 2022 U.S. average tariff rate was 3.4 percent, so this proposal would substantially increase the cost to import. Trump argues that the 10% tariff would be used to pay off U.S. debt, but a 10% import tax is hardly enough to make a dent in the record $32 trillion of government debt. Instead, Trump’s proposed tariffs would significantly raise taxes on American businesses – and more specifically SMEs – many of which have profit margins approximately the size of the tax.

Overall Domestic Impact

The U.S. Census Bureau reported 226, 662 identified U.S. importers in 2021 (a number that has likely increased). Therefore, the proposed tariffs would result in over 220,000 American businesses taxed at least 10% on every imported good. Faced with higher import costs, many American firms may be forced to raise prices, accept lower profit margins, or downsize. Trump already imposed some significant tariffs during his first Presidential tenure, most notably on Chinese products, as well as steel and aluminum. Erica York of the Tax Foundation estimates that the eventual consequences of these existing tariffs – which have continued under the Biden administration – will be reductions in long-run GDP by 0.21%, wages by 0.14%, and employment by 166,000 full-time jobs. York also studied the domestic impacts of Trump’s new 10% tariff, predicting the proposed tax would “shrink the U.S. economy by 1.1 percent and threaten more than 825,000 U.S. jobs.”

Impact on SMEs

SMEs may face harsh consequences from Trump’s proposed tariff. Many small businesses have lower profit margins than their larger counterparts and would likely struggle to afford the type of tax proposed by the 10% tariff. Of the $2.4 trillion of import value in 2021, the U.S. Census Bureau calculated that SMEs imported $839 billion worth of goods.

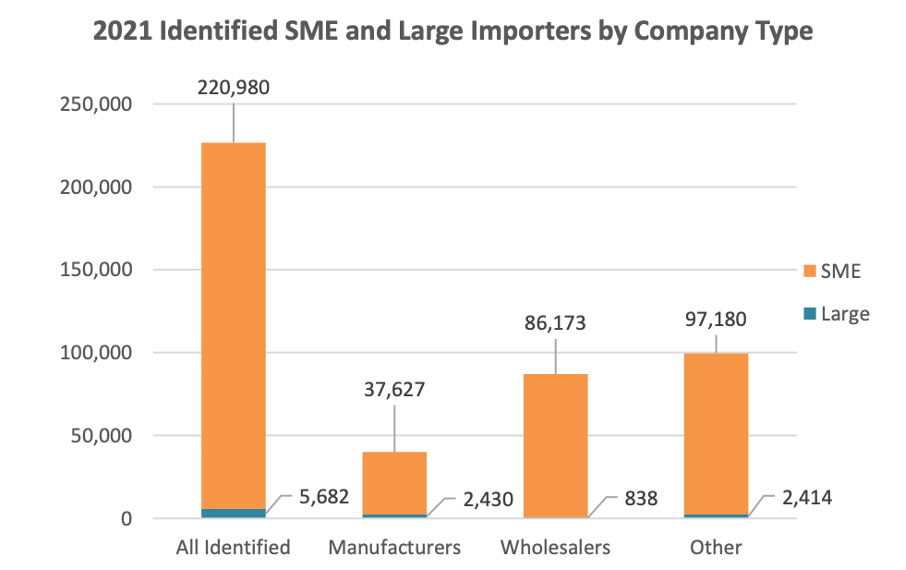

Through simple calculations, if SMEs were to keep importing $839 billion worth of goods annually, Trump’s 10% tariff would result in at least $83.9 billion worth of import taxes for SMEs every year. The impact of tariffs on SMEs is even clearer when considering the number of these businesses that are importers. In 2021, 97.5% of U.S. importers were SMEs.

Tim Parker of Investopedia estimates a “healthy profit margin for a small business tends to range anywhere between 7% to 10%.” The proposed 10% tariff can only mean increased strain for the 220,980 and counting SMEs who rely on imports for their business. More competitive import prices allow firms to offer lower prices to consumers. Additionally, over 59% of U.S. imports in 2021 were intermediate goods (inputs used to produce final products). Allowing U.S. firms to import intermediate goods at lower prices allows them to export their products at more competitive prices on the international market.

If many SMEs have profit margins of less than 10%, the heavy proposed tax may cause many American businesses to fail, and others to significantly raise prices. SMEs are vital to the U.S. economy. U.S. Customs and Border Protection estimates that “small businesses represent 99.9 percent of all United States businesses and employ 47.1 percent of the U.S. workforce.” While not all these firms rely on imports for their operations, clearly small business entrepreneurship is at the heart of the U.S. economy.

Conclusion

While the current U.S. debt is an extremely important issue, imposing a sizeable raise in import tariffs may not be an effective way to fix it. Former President Trump’s 10% tariff proposes an extreme tax spike that could be predominantly paid by U.S. businesses. Collecting likely over $83.9 billion of import taxes annually may seem like a viable method for beginning to address the U.S. debt, but it would come at an immense cost for over 220,000 American SMEs. If Trump wants to shrink the record U.S. debt, he may have to consider reducing government spending or proposing a more effective tax in a different area. Considering that 97.5% of U.S. importers are SMEs, the proposed tax could potentially limit the capabilities of American entrepreneurship, which may stifle innovation throughout the country.

You must be logged in to post a comment.