Executive Summary

- On May 22, 2025, the House of Representatives passed a budget reconciliation bill which includes many key provisions relating to health care policy – including broad reforms to Individual Coverage Health Reimbursement Arrangements (ICHRAs) and Health Savings Accounts (HSAs).

- The provisions included in the bill offer new tax credits, widen eligibility criteria for participants, increase contribution limits, and allow for more qualified uses of funds.

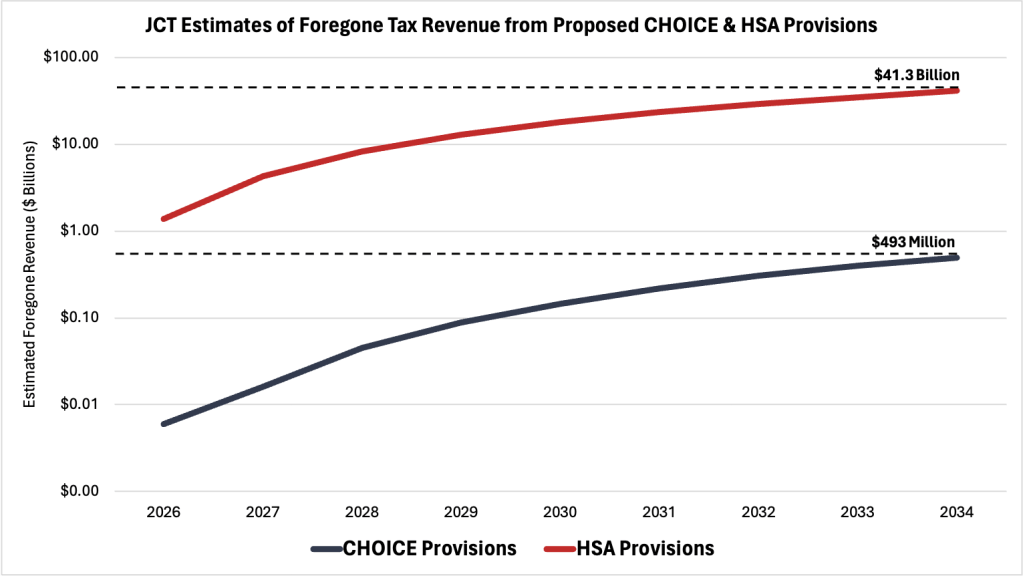

- The proposed changes to ICHRAs and HSAs are estimated to result in almost $42 billion in foregone federal revenue over the next decade.

Introduction

On May 22, 2025, the House of Representatives passed a budget reconciliation bill – referred to as the “One Big Beautiful Bill Act” – which includes many key provisions relating to health care policy. While the proposed changes to Medicaid and the Affordable Care Act garner more public attention, the additional changes to Individual Coverage Health Reimbursement Arrangements (ICHRAs) and Health Savings Accounts (HSA) may represent more significant contributions to the Administration’s vision for health coverage reform in the United States.

The proposed reforms to ICHRAs and HSAs aim to promote their large-scale adoption across the U.S. health care system. This insight will provide a brief overview, largely guided by Katie Keith’s recent article in Health Affairs, of how ICHRAs and HSAs function, what the new provisions are designed to change, and estimates of the potential fiscal impact of the bill.

What are Individual Coverage Health Reimbursement Arrangements?

An Individual Coverage Health Reimbursement Arrangement (ICHRA) is a type of traditional health reimbursement arrangement (HRA), which allows employers to contribute to their employees’ qualified health expenses (including insurance premiums) on a pre-tax basis. Whereas traditional HRAs are typically integrated with group health insurance plans, ICHRAs require employees to shop for policies in the individual health insurance marketplace. Because ICHRAs work with individual health insurance policies, participants have greater flexibility in determining the level of contributions and coverage. In theory, a fully customized ICHRA supports the most beneficial and cost-effective insurance plan for each employee, while still allowing employers to control annual overhead costs and receive significant tax advantages.

ICHRAs were established via a rule issued jointly by the Departments of Health and Human Services, the Treasury, and Labor. The Internal Revenue Service issued guidance in 2019 providing the integration of traditional HRAs with individual health insurance coverage under certain conditions. Since ICHRAs were first made available in 2020, the arrangement has observed only modest overall adoption among firms offering health benefit options, despite significant year-to-year growth. In 2024, a survey by the Kaiser Foundation found that only 4 percent of firms provide funds for employees to purchase non-group health insurance plans (including ICHRAs). While some firms, particularly small businesses, indicated their interest in providing individual coverage arrangements within the next 2 years, the survey indicates that ICHRAs currently play a relatively small role in the health care marketplace.

Even without the new incentives outlined in the budget reconciliation bill, ICHRAs are projected to grow in the private sector over the next decade. With per-employee health benefit costs expected to increase by almost 6 percent for the third year in a row, many companies see the cost predictability and generally lower premiums associated with individual policies as a reason to adopt ICHRAs. Although there are many challenges – including market skepticism – facing both employers and employees that may ultimately limit its expansion, one estimate holds that ICHRAs could support more than 10 million Americans by 2029.

What are Health Savings Accounts?

A Health Savings Account (HSA) is a type of personal savings arrangement that allows individuals to withdraw tax-free dollars to pay for qualified medical expenses. HSAs are available for people with eligible health plans – commonly referred to as High–Deductible Health Plans (HDHP) – and are characterized by accountholders with lower monthly health care premiums and higher out-of-pocket costs. Under current regulations, HSAs have limits on the amount accountholders can contribute annually; however, these funds do not expire and are carried over to the next year. Typically, individuals with HSAs utilize these accounts for the significant tax advantages, flexibility in health care spending options, and protection from potentially catastrophic out-of-pocket health care costs.

The HSA system was first implemented by guidance issued by the Treasury Department in 2003, which included general rules on taxes and how the funds can be accessed by eligible accountholders. Since the HSA system was operationalized, HSAs have assumed a considerable role in the market, with data indicating more than 14 million accounts and $43 billion in assets by the start of 2023.

The growth in HSAs over the past decade is directly correlated with the rising availability of HDHPs across the private sector. Private sector employees observed a 32 percent increase in the availability of HDHPs from 2015 to 2024, with higher availability for workers in the service-providing industries. As of 2024, about 40 percent of all private sector workers have access to HSAs – with this rate reaching almost 60 percent among large employers.

Changes to ICHRAs and HSAs from the Budget Reconciliation Bill & Fiscal Impact

As discussed previously, the budget reconciliation bill passed by the House of Representatives makes several important changes to both ICHRAs and HSAs. Broadly speaking, these proposed changes are designed to enhance the flexibility of ICHRAs and HSAs and provide tax incentives for both individuals and their employers. Proponents of the bill contend that these changes will promote more personalized and cost-effective health care coverage options, while simultaneously foregoing billions of dollars in taxes annually.

ICHRA (CHOICE Arrangement) Provisions

The first notable change to ICHRAs from the budget reconciliation bill amends the tax code that would codify almost all previous guidance on ICHRAs under the new term “CHOICE Arrangements.” Consistent with guidance issued in 2019, CHOICE arrangements are tax-advantaged health benefits funded solely by employers, which are used to reimburse an employee’s qualified medical expenses (including premiums) in the individual health insurance marketplace (or Medicare). The only difference between ICHRAs and CHOICE arrangements – apart from the name – is omission of the “excepted benefit HRA” option, which allows for some policies beyond the scope of individual coverage or fully-insured student health insurance.

The bill would implement a new tax credit for small businesses that provide CHOICE arrangements for their employees. Beginning in 2026, eligible employers – who also satisfy the established minimum essential coverage – would receive a tax credit of $100 per employee per enrollee month during the first year of the CHOICE arrangement. The tax credit amount would decrease to $50 the following year and then be adjusted annually for inflation.

In addition to the proposed tax credits, the bill would also permit employees to purchase marketplace individual health insurance policies through salary reductions contributed to cafeteria plans. This provision eliminates regulations under Section 125 of the Internal Revenue Code, which require employees with integrated ICHRAs and cafeteria plans to purchase policies not on the health care marketplace exchange (losing access to premium subsidies). If enacted, the bill may encourage more employees to use CHOICE arrangements (ICHRAs) in conjunction with cafeteria plans, to help cover qualified medical costs (including insurance premiums) that are not fully reimbursed by the defined employer allowances.

The Joint Committee on Taxation (JCT) estimates that the three provisions related to ICHRAs (CHOICE Arrangements) included in the budget reconciliation bill may lead to nearly $500 million in foregone federal revenue over the next decade.

HSA Provisions

Perhaps the most consequential change to HSAs is a provision which would allow many individuals to double their annual contributions. For fiscal year 2025, HSAs have strict annual contribution limits set at $4,300 for individual coverage and $8,550 for family coverage, regardless of the accountholder’s income; although older individuals (those 55 years old and above) may contribute an additional $1,000 for individual coverage. The provision included in the reconciliation bill would increase these annual limits, starting in fiscal year 2026, to $8,600 and $17,100 for individual and family coverage, respectively, but only for accountholders below a $75,000 income threshold. Given the tax-advantages gained by contributing to HSAs, the JCT projects that this new rule may forego over $8 billion dollars in tax revenue over the next decade, which indicates the potential for significantly higher utilization of HSAs among eligible Americans.

The bill also seeks to expand the eligibility criteria by including a provision which allows all bronze and catastrophic health insurance plans purchased in the marketplace to qualify for HSAs. This provision effectively eliminates the maximum out-of-pocket cost requirements for high-deductible health plans (the only type of plan eligible for HSAs), which have historically served as the barrier for many bronze and all catastrophic health insurance policyholders. The JCT estimates that widening the eligibility of HSAs to include bronze and catastrophic plans may forego an additional $3.5 billion in federal tax revenue – which is not included in the $8 billion figure from the previous provision.

To further enhance HSA eligibility, the bill proposes several new rules which allow for more qualified contributions. Americans who are 65 and older (and therefore entitled to Medicare benefits) with high-deductible health plans will be permitted to continue makings tax-free contributions to their HSAs. This update is important because individuals who are 65 and older can withdraw funds from HSAs to pay non-medical or non-qualified medical expenses without punitive taxes. Other eligibility-related provisions added to the bill include allowing individuals to contribute to their spouse’s HSA, permitting HSA contributions for on-site employer health facilities, and authorizing individuals aged 55 and older to use “catch-up” contributions for their spouses’ HSA.

In terms of fiscal impact over the next decade, the provisions which expand the types of qualified medical expenses that HSAs can reimburse are projected to be the most meaningful. As part of the bill’s tax relief plan, one provision would reclassify certain “physical activity, fitness, and exercise” as medical care – making gym membership fees and other exercise-associated costs eligible for up to $500 in reimbursements from HSAs annually. The JCT predicts that this provision alone will forego over $10 billion in federal tax revenue by fiscal year 2034. The bill will also allow HSA accountholders with direct primary care (DPC) memberships to use their HSA contributions to pay DPC fees. Moreover, the bill clarifies that DPC’s are not recognized as health plans – meaning participants will be allowed to continue making contributions to their HSAs. The JCT estimates that the integration of DPCs and HSAs will lead to an additional $2.8 billion in lost federal revenue over the next 10 years.

Combined, the proposed changes to ICHRAs (CHOICE arrangements) and HSAs – in tandem with changes to Medicaid and the Affordable Care Act (ACA) – are projected to eliminate over $41 billion in tax revenue by 2034 and reshape health care markets in the United States. Importantly, the estimates provided by the JCT (see chart below) attempt to account for the interaction of each provision in calculating the potential fiscal impact of the bill. For example, the proposal to limit eligibility for ACA marketplace subsidies and cost-sharing reductions may lead many individuals to consolidate their health care coverage or drop it entirely, potentially weakening competition in the marketplace. As more Americans become underinsured or uninsured, the risk pools and their associated monthly premiums may worsen (even across arrangement classes), making CHOICE arrangements a far less attractive offer for both employees and employers. These potential challenges should inform policymakers and stakeholders as the merits of the budget reconciliation bill provisions are discussed in the reconciliation process.

Source: The Joint Committee on Taxation

Conclusion

The House budget reconciliation bill includes many highly consequential reforms to Individual Coverage Health Reimbursement Arrangements (ICHRAs) and Health Savings Accounts (HSAs), which aim to improve health care coverage flexibilities and provide greater tax-advantages for Americans. While it is difficult to gauge how these provisions will interact in practical terms, the JCT estimates that the provisions relating to ICHRAs and HSAs will result in over $41 billion in foregone federal tax revenue over the next decade.

You must be logged in to post a comment.