Executive Summary

- Housing in the United States reached a new low in terms of affordability in May 2025, according to The Federal Reserve Bank of Atlanta’s Home Ownership Affordability Monitor, largely because of a lack of supply in the housing market.

- President Trump’s main policy strategies, raising tariffs and decreasing the immigrant population in the U.S., will increase the cost of homebuilding.

- Increasing the costs of residential construction will decrease the supply of houses and raise prices, making it even harder for Americans to buy their first home.

Introduction

There is a housing supply shortage in the United States which is skyrocketing home prices. The Federal Reserve Bank of Atlanta’s Home Ownership Affordability Monitor reached 64 for the total U.S. market in May 2025. This is the lowest number on record and well below 100, the benchmark for “affordable.”

In January 2025, a White House memorandum asserted that President Trump wants to “lower the cost of housing and expand housing supply,” especially by decreasing homebuilding regulations. However, the regulations which cause high building costs are often hyper-local and cannot be changed by the federal government. Trump should instead focus on not increasing homebuilders’ costs, but his foreign policy goals are taking precedence and raising construction costs. Tariffs increase the cost of construction inputs, and anti-immigration policies remove a significant portion of the construction labor force, worsening labor shortages. This will limit construction of new houses, keep supply low and make it harder for Americans to buy their first home.

Barriers to Construction

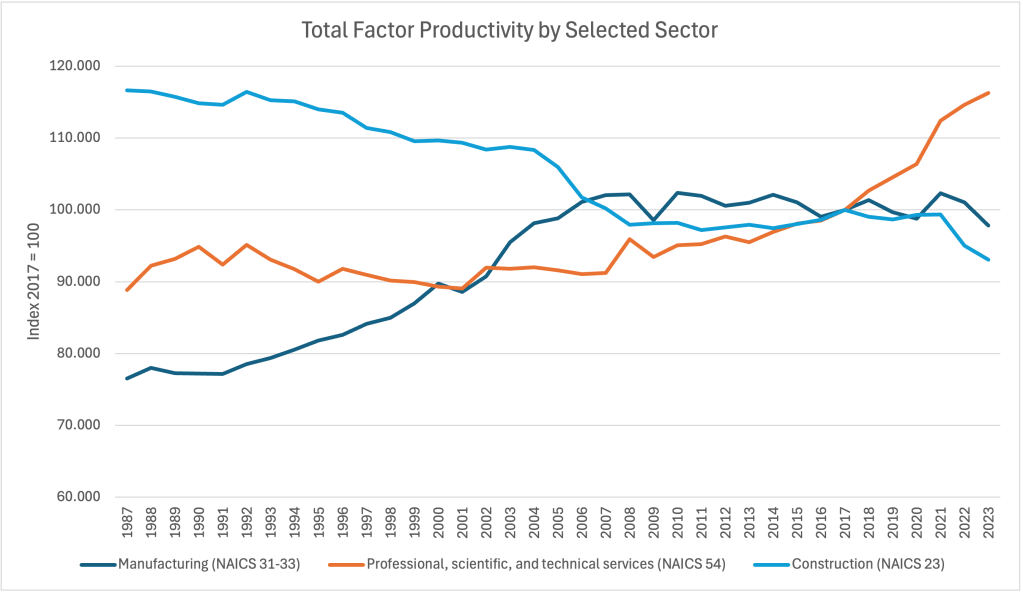

Alarmingly, productivity in the construction sector has decreased over the past 40 years. This lack of industry growth, along with labor shortages, high regulatory costs, and expensive construction materials, means that there are not enough houses being built to keep up with demand. This is especially true for “starter homes” since it is less worthwhile to build smaller houses that will sell for less when the cost of construction is high.

Economic scholarship largely agrees that homebuilding is constrained by high regulatory costs put in place by local governments, a practice often referred to as NIMBY. Though people recognize the need for more affordable housing, those who already own homes want to ensure that their home equity is protected, so they opt to preserve supply-constraining practices within their neighborhoods. This includes zoning ordinances such as minimum lot sizes and regulations which limit prefab housing.

Prefabricated, or manufactured, housing is built in a factory and assembled on-site, an innovation which may boost future productivity in home construction. These houses are often affordable enough to be considered “starter homes,” but they face higher costs because each locality has different zoning requirements. Relaxed zoning laws and productivity increases through innovations in prefab housing could increase the supply of housing in the U.S. and lower the price of homes.

Tariffs and Input Costs

One reason for high housing costs is the ever-increasing price of construction inputs. The cost of construction materials has been rising at a higher rate than the total cost of commodities for many years due to supply chain issues, high demand, and tariffs. Important house-framing materials have a long history of being tariffed and are at record highs, including steel at 50% and softwood lumber at 35%. During COVID-19, this problem was made worse when the cost of construction materials spiked due to higher supply chain volatility and increased demand from the housing boom. With the cost of these inputs so high, less houses are built due to shrinking profit margins.

President Trump’s tariffs are already increasing the cost of construction inputs. The effective tariff rate is found by dividing duties collected by the value of goods taken through customs to show actual price increases of goods imported into the US. For 438 goods that are commonly used in residential construction and remodeling, the average effective tariff rate is 11.3% in year-to-date 2025. This is up from 7.6% in 2021, when many tariff exemptions for homebuilding goods expired. In 2017, the effective tariff rate for these goods was just 2.1%.

These tariffs are supposed to incentivize Americans to manufacture more goods at home, but they will instead decrease the production of houses in the U.S. because Trump mistakes the role of globalized trade. Adam Smith famously explained the importance of labor specialization by describing the role of a pin factory. While one man could maybe create one pin if given materials and several hours, a factory with each man doing a highly specified task can create several pins per man per second. Today, Americans offshore most of the production of pins (and their construction equivalent: nails and tacks), allowing the U.S. to focus resources elsewhere. If the government raises tariffs on tacks and nails to 37.4%, Americans will either shift production and investment from more efficient sectors into tack-making, or the cost of building a house will increase that much more, disincentivizing homebuilding.

| HTS Number | Product | 2017 | 2021 | 2025-YTD |

| 7317.00.65 | Nails and tacks | 0.0% | 6.6% | 37.4% |

| 7005.29.25 | Windows | 1.5% | 3.6% | 4.5% |

| 7321.11.30 | Gas stoves | 0.0% | 1.8% | 30.7% |

| 2516.12.00 | Granite Countertops | 0.6% | 3.1% | 7.9% |

| 6907.21.30 | Ceramic Tiles | 7.7% | 8.7% | 9.7% |

| 9403.40.90 | Kitchen Cabinets | 0.0% | 1.6% | 3.8% |

| 7408.21.00 | Copper-zinc base alloys (brass) wire | 1.8% | 2.3% | 5.3% |

| 7314.20.00 | Iron/steel, grill, netting & fencing | 0.0% | 4.6% | 27.5% |

| 7308.30.10 | Stainless steel doors, windows and their frames and thresholds | 0.0% | 3.2% | 13.9% |

| 7324.21.10 | Bathtubs | 0.0% | 1.1% | 33.3% |

The market for construction inputs already suffers from supply chain issues, price volatility, and uncertainty. Tariffs add to this uncertainty and directly increase the price of many inputs to homebuilding. This makes it costlier to produce homes, which will decrease housing supply and raise prices.

Immigration Policy and Labor Supply

Another important construction cost is labor, which is already in short supply. President Trump’s policies aimed at deporting undocumented workers will further decrease this labor availability, which will increase home prices. Of the tradesmen that make up around two thirds of the construction labor force, nearly a quarter are immigrants without a college degree, a total of 2.2 million people as of May 2025.

This ratio is still higher in certain trades. Data from the American Community Survey (ACS) Public Use Microdata Sample (PUMS) compiled by the National Association of Home Builders show that well over half of all plasterers, drywall and ceiling installers, roofers, and painters are immigrants. Moreover, labor shortages within the industry are often filled by immigrant laborers. As Trump continues to suppress immigration, there will be serious ramifications for housing supply as construction firms struggle to find willing laborers.

In fact, Trump’s policies may already be negatively affecting firms’ ability to find enough labor to build new houses. The unemployment rate within the construction industry decreased from 5.6% in April 2025 to 3.4% in July 2025, according to the Bureau of Labor Statistics. In June 2025, hiring was down 32,000 from the month before, job openings decreased by 7,000, and there were 44,000 separations. This data indicates that workers are leaving the labor force and not returning, which may be due to fears of deportation. Another explanation for this data is that firms may be giving up in the face of rising costs, a decreasing labor supply, and higher uncertainty.

Conclusion

The high price of a home in the United States makes it hard for families to purchase their first home. More housing could begin to solve this problem, but residential construction is a complicated issue. Local ordinances hold the most sway over the number of houses built, and federal policy should simply focus on not making things worse. Instead, President Trump’s tariffs and immigration policy threaten to increase costs still more, adding strain to an already-fragile housing market.

You must be logged in to post a comment.