Executive Summary

- The U.S. dollar’s position as the preeminent global reserve currency for international trade and transactions is under threat from countries across the world – particularly Brazil, Russia, India, China, and South Africa (BRICS) – that seek greater economic autonomy.

- BRICS nations plan to become less reliant on the U.S. dollar by circumventing it as a payment intermediary, replacing it with a stable coin called BRICS Pay as an alternative to the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

- BRICS Pay may pose a threat to dollar dominance in the long-term, but it is currently not a viable global alternative to SWIFT; however, the combined efforts of nations diversifying their reserves is cause for U.S. concern moving forward.

Introduction

Since the inception of global trade, there has always been a dominant, trusted currency used to facilitate transactions between parties to avoid the double coincidence of wants associated with bartering. The U.S. dollar (USD) has been the premiere global currency since the Bretton Woods Agreement of 1944 where it was crowned in replacement of the British Pound. Today, the USD makes up 88 percent of all foreign exchange transactions, nearly 60 percent of global reserves, and 65 countries peg their currency to the dollar. This is not imposed by force, as reliance on the dollar developed out of the convenience of having a single intermediary that limits transaction costs.

Now, as the global community seems to be transitioning away from the USD in favor of alternatives such as the Chinese Renminbi, confidence in the USD as the global reserve currency has been shaken, particularly after the United States seized Russian assets and removed Russia from the Society for Worldwide Interbank Financial Telecommunications (SWIFT) in response to the invasion of Ukraine. Governments around the world are purchasing unprecedented levels of gold and increasing trade in local currencies, most prominently from BRICS (Brazil, Russia, India, China, and South Africa).4

The BRICS countries are not all on the same playing field, as real GDP per capita has grown 138 percent in China, 85 percent in India, 13 percent in Russia, 4 percent in Brazil, and declined by 5 percent in South Africa between 2008 and 2021. China is the unrivaled heavyweight within BRICS as it represents 69.53 percent of the countries’ collective total GDP in 2022 and the Chinese Renminbi has the greatest potential of replacing the USD within BRICS transactions.

| Organization | Share of Global GDP | GDP per Capita | Share of Global Trade |

| BRICS | 25.66% | $7,977 | 16.01% |

| G7 | 43.33% | $56,455 | 32.62% |

BRICS Alternatives to the West

Alongside encouraging greater dialogue between BRICS nations, the organization has focused on challenging the global economic institutions set up under Bretton Woods. The New Development Bank is the BRICS version of the World Bank, with approximately $100 billion in capital for various kinds of development projects. Each founding country has an equal stake of close to 20 percent of this investment pool, but BRICS+ countries such as Bangladesh, Egypt, and the UAE have begun buying in. While the portfolio financing of the New Development Bank has historically been over 60 percent in USD, 2021 annual funding was denominated only 31 percent in USD as the Euro and Renminbi replaced the dollar. While small compared to the World Bank, this trend represents a substantial shift away from the USD, an impact that is likely to grow as 25 countries have expressed interest in joining BRICS for these economic benefits.

| Currency | Percent of Total Project Financing | Percent of 2021 Project Financing |

| United States Dollar | 64.96% | 31.09% |

| Chinese Renminbi | 18.44% | 31.8% |

| Euro | 9.87% | 37.11% |

| South African Rand | 4.50% | – |

| Swiss Franc | 1.88% | – |

| Indian Rupee | 0.34% | – |

The Contingent Reserve Arrangement (CRA), the BRICS version of the International Monetary Fund (IMF), provides financial support in the case of a liquidity crisis with roughly $100 billion in commitments, the largest being from China at $41 billion. Under the current CRA system, a local currency is swapped for USD in the case of a liquidity crunch, but each country can only request 30 percent of its entitled amount while the remaining 70 percent is linked to an IMF conditionality agreement. In comparison, the IMF has Special Drawing Rights (SDR) where countries cash in SDR that are linked to a basket of currencies for liquidity. Therefore, the CRA is heavily dependent on the IMF and arguably more reliant on USD than SDR, which bodes well for dollar dominance within this institution.

| Organization | Form of Liquidity | Total Available Liquidity |

| International Monetary Fund | SDR Currency Basket | $935.7 billion |

| Contingent Reserve Arrangement | U.S. Dollar | $100 billion |

BRICS nations have collaborated extensively on developing alternate financial payment networks to compete with SWIFT, which could incorporate the widely discussed BRICS common currency. Each member of BRICS, except for South Africa, has developed its own national payment systems with independent retail banking to avoid reliance on U.S. banks. In terms of cross-border payment cooperation, there exists the BRICS Interbank Cooperation Mechanism (BICM), the New International Payment System (NIPS), and BRICS Pay. Each of these financial payment systems are designed to limit the ability of Western nations to target assets or halt financial messaging in the case of sanctions.

BRICS Pay is a digital payment platform that uses NIPS to facilitate transactions between consumers of member countries. The intermediary currency is the New Silk Road BRICS Token (NSRB), which is a blockchain technology. To use this, someone would open BRICS Pay to convert their local currency into NSRB to make a purchase. The NSRB would flow through NIPS processing centers and clearing banks to the deposit account of the recipient who can then convert it into their local currency. Currently, there are no defined conversion rates between NSRB and BRICS currencies, but one NSRB is supposed to equal 100 USD for the sake of stability. Unfortunately for those beta-testing NSRB, it is only worth somewhere between $27 and $52, meaning it may be down over 50 percent since its inception.

| Financial Communication System | Example Payment Platform | Primary Intermediary Currency | Integrated Countries |

| SWIFT | Apple Wallet | USD | 200 |

| NIPS | BRICS Pay | NSRB | 5 |

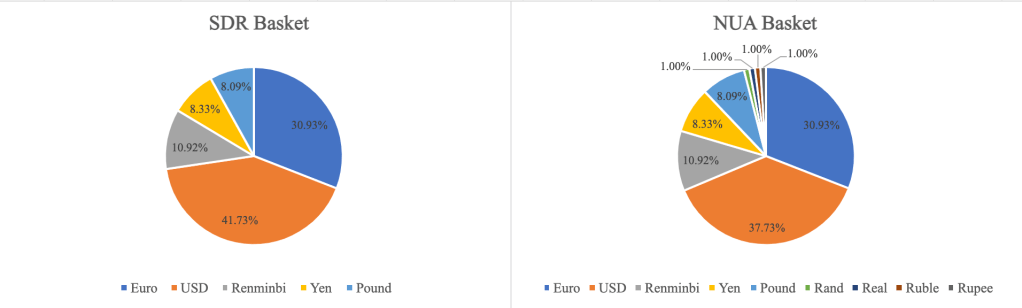

The NIPS and BICM systems could also use the SDR basket or a New Unit of Account (NUA) basket as intermediaries for financial transactions between banks if NSRB does not live up to expectations. In any case, blockchain technology is the foundation for BRICS overcoming dependency on USD in the future. For now, BRICS Pay has limited scope, has not been widely rolled out to citizens, and still relies upon the USD for financial stability.

De-dollarization Around the World

Numerous organizations and governments are calling to end dependency on the dollar in favor of local currency and diversifying the risks associated with a single dominant currency. The de-dollarization movement is experiencing more than just lip service in the form of bilateral trade agreements using local currencies, oil trades being denominated in gold or Renminbi, and reducing reserve holdings of USD. A significant move in this de-dollarization movement is the fact that Saudi Arabia has begun trading in oil using Chinese Renminbi, the first time in nearly 50 years it has used a currency other than USD.

| Country/Organization | Type of Challenge to Dollar Dominance |

| ASEAN | Increase Local Currency in Trade |

| Argentina | Trade in Renminbi with China |

| Bangladesh | Trade in Rupee with India |

| Bolivia | Trade in Renminbi with China |

| Brazil | Increase Local Currency in Trade |

| China | Increase Local Currency in Trade |

| Egypt | Trade in Rupee with India |

| Ghana | Buying Oil with Gold |

| India | Increase Local Currency in Trade |

| Indonesia | Increase Local Currency in Trade |

| Iran | Increase Local Currency in Trade |

| Iraq | Banned USD for Domestic Trade |

| Kazakhstan | Increase Local Currency in Trade |

| Malaysia | Calls for Asian Monetary Fund |

| Myanmar | Trade in Renminbi with China |

| Pakistan | Trade in Renminbi with China and Oil |

| Russia | Trade in Renminbi with China |

| Saudi Arabia | Pricing Oil Sales in Yuan |

| United Arab Emirates | Trade in Rupee with India |

| United Nations | Calls for Super-Sovereign Reserve Currency |

| Venezuela | Increase Local Currency in Trade |

Looking Ahead: Impacts on Dollar Dominance

Total global trade value in 2022 was estimated at $25.3 trillion in goods and $6.8 trillion in commercial services. Assuming the BRICS countries can implement a common currency for trade, they would be able to obtain an immediate global trade share of roughly 3 percent, which would most heavily impact USD. Renminbi makes up 7 percent of forex trades – the marketplace for exchanging national currencies – which would likely also see a substantial increase if BRICS were to circumvent the dollar. While this may not have a strong immediate impact, the ripple effects on foreign exchange reserves and the potential of BRICS+ countries joining de-dollarization presents a long-term challenge to the USD.

With more countries using Renminbi in trades, Renminbi has increased from under 1 percent of foreign reserves in 2015 to 3 percent in 2022. Maintaining this growth means Renminbi will hit 5 percent in the next decade, almost exclusively targeting the USD share of reserves. The combination of local currencies (excluding the Pound and Euro) could make up nearly 25 percent of global reserves in the next 10 years. (These trends do not factor in increased BRICS Pay usage or the increasing rate at which countries are diversifying their reserve portfolios.)

Using regression analysis and extrapolating the median growth rates for the last 10 years, the USD is expected to make up roughly 52.59 percent of global reserves around the year 2032. The regression has an R2 value of 0.7588, which means that close to 76 percent of the variation in USD as a reserve currency can be explained via other currencies.

Regression Formula:

USD Reserves = 4.08PoundReserves – 0.53EuroReserves – 1.60OtherReserves + 73.63

| Year | Currency | Share of Global Reserves | USD Correlation | Change in Reserve Share |

| 2012 | USD | 61.40% | 1.00 | – 4.05% |

| 2012 | Euro | 24.10% | 0.98 | -0.03% |

| 2012 | Pound | 4.00% | 0.90 | +1.10% |

| 2012 | Other | 10.40% | 0.70 | +3.70% |

| 2022 | USD | 58.40% | 1.00 | -3.00% |

| 2022 | Euro | 20.50% | -0.33 | -3.60% |

| 2022 | Pound | 4.90% | -0.60 | +0.90% |

| 2022 | Other | 16.30% | -0.85 | +5.90% |

| 2032 | USD | 52.59% | 1.00 | -5.81% |

| 2032 | Euro | 18.42% | 0.94 | -2.08% |

| 2032 | Pound | 5.75% | -0.95 | +0.85% |

| 2032 | Other | 23.24% | -0.96 | +6.94% |

The greatest contributor to the decline in the USD is not the Euro, currently the second leading reserve currency, but a combination of all other local currencies. The Euro and the USD have grown to be more positively correlated while the dollar and all other currencies have become more negatively correlated. This can be attributed to both major currencies shrinking as a percentage of global reserves due to greater diversification. The rate of diversification is increasing: Every 10 years between 2002 and 2032 the growth as a percentage of global reserves has been 3.70 percent, 5.90 percent, and 6.94 percent, respectively.

The USD world reserve status finances a large portion of the budget deficit in the United States, which means that a degradation of this privilege would impact its ability to provide services, fund the military, and maintain great power status. It would likely result in higher interest rates restricting economic growth, a contraction in trade, and greater costs for U.S. companies investing overseas. Therefore, the loss of dollar dominance would not be easily brushed off and would be a significant long-term challenge to U.S. economic security.

Conclusion

At present, the United States remains the largest economic power and maintains dollar dominance in trade and foreign reserves. BRICS is attempting to circumvent the dollar with NSRB but has seen limited success in providing a stable alternative to Western institutions and has in many cases created alternatives that rely on USD. The Chinese Renminbi is growing in attraction globally, and may provide a basis for future BRICS liquidity, but has yet to gain wide-spread traction in the international community. Numerous other nations have begun trading in local currencies, which has led to a noticeable chipping away of the dollar over the past few decades. The rate of diversification appears to be growing but the USD has over a decade before it constitutes less than half of reserves based on current trends. Therefore, the notion of a BRICS common currency is less of a threat in the short term than the increasing use of local currencies when it comes to the long-term preservation of dollar dominance.

You must be logged in to post a comment.