Executive Summary:

- President Trump’s frequently changing tariffs increased uncertainty for many businesses owners. This uncertainty could potentially damage the economy by reducing investment and new research and development processes.

- Polymarkets allow anyone to bet on an outcome by buying a yes share or a no share, with the price of a yes share corresponding to the probability of a yes outcome. This analysis uses the yes share prices of Polymarkets to measure both the accuracy and certainty of Polymarket predictions for tariff outcomes.

- This analysis finds several Polymarkets with high levels of certainty for inaccurate predictions and an overall inability of prediction markets to consistently predict tariff rates, demonstrating uncertainty in the economy as a whole.

On February 1st, 2025, Trump signed an executive order imposing tariffs on imports from Mexico, Canada, and China. Two days later, Trump agreed to a 30-day pause on these trade threats. Since then, Trump has announced a myriad of tariffs, many of which he has paused or completely revoked in the following days. Media outlets have even adopted the name “TACO” (Trump Always Chickens Out) to describe the President’s tariff policy.

Tariff policy itself causes great uncertainty for businesses as they must reevaluate supply chains, examine costs, and adjust prices accordingly. However, Trump’s tariffs add further uncertainty through their rapid changes. As businesses attempt to plan their production, investment, and profit, they must consider not just new tariff rates, but the possibility of increased tariff rates or no tariffs at all. A recent survey by the Federal Reserve Bank of Boston found that uncertainty increased among small and medium businesses who imported in both February and April 2025, with businesses most concerned over their profit margins, head count, and investment.

Uncertainty in an economy can be incredibly destructive, especially as it can reduce investment and the technological growth typically driven by costly and risky research and development processes. This leads to a further question: beyond businesses, how uncertain is the market about Trump’s tariffs? Is there any predictability to Trump’s tariffs that can be used to limit the uncertainty faced by business owners?

There are several existing measures of uncertainty within an economy, such as the Economic Policy Uncertainty Index (EPU), which uses newspaper coverage and temporary tax code provisions to measure uncertainty. Other measures examine the variance between different economist’s predictions for economic variable. However, prediction markets offer a natural case-study of the predictability of Trump’s tariffs for the market as a whole, as anyone can buy and sell shares betting on a future outcome. In recent years, prediction markets have at times been more accurate than traditional polls, even accurately predicting the outcome of the 2024 Presidential Election. This accuracy leads to the question of whether prediction markets may be able to offer some insight into Trump’s tariff policies, potentially allowing businesses to decrease their uncertainty.

The following analysis examines Polymarket, the largest prediction market in the world. The resolved Polymarkets focused on tariffs with the highest liquidity and available data were selected for analysis. Note that the price of a share in a Polymarket reflects the current odds of an outcome. For example, if a yes share is trading at $0.18, there is believed to be an 18% chance of that outcome occurring. The prices of a yes share recorded each day at 0:00 are analyzed in three different ways. First, the prices themselves are graphed to show fluctuations in the Polymarket. Next, a running average of the prices is graphed. Finally, the overall average of the prices is also graphed. Below, Figure 1 shows a graph displaying all three lines.

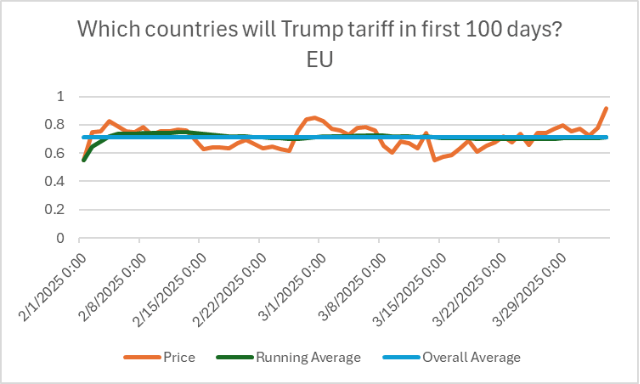

Figure 1

From there, each graph is analyzed in accordance with the actual outcome of the event, and thus both the certainty of a Polymarket in a prediction and the accuracy of the prediction are considered. Uncertainty is classified in four levels. The price range $0.40-0.60 is deemed very uncertain, $0.25-0.40 and $0.60-0.75 are deemed moderately certain, $0.10-0.25 and $0.75-0.90 are deemed highly certain, and $0.00-0.10 and $0.90-1.00 are nearly completely certain. Three Polymarkets are examined in detail: “Trump imposes 40% tariff on China in first 100 days?”, “Will Trump Remove Tariff on Canada Before May”, and “Which Countries will Trump Tariff in the first 100 days: EU”. Six other Polymarkets were also examined.

Figure 1 shows the Polymarket for “Trump imposes 40% tariff on China in first 100 days?” was highly certain of a no outcome as the average price of a yes share was approximately $0.13. Note that Trump signed an executive order on February 1st for a 10% tariff on Chinese goods and that Trump raised tariffs on Chinese goods to 20% on March 3rd. Interestingly, these increases in tariffs did not significantly increase the price of a yes share, with the price of a yes share remaining under $0.10 even after March 3rd. However, on April 2nd, as part of his Liberation-Day tariffs, Trump’s tariffs on China increased to a total rate of 54%, resulting in a yes outcome for the Polymarket. Thus, for this Polymarket, the predictions seem to be highly inaccurate, despite the high certainty of market.

Figure 2

Figure 2 tells quite a different story. From the start, the Polymarket “Will Trump Remove Tariffs on Canda Before May” did not seem certain of either outcome, hovering around $0.50 for a yes share for the first few weeks. The market became increasingly certain of a no outcome throughout February but spiked back to a yes outcome following the announcement of a 25% tariff on Candian goods on March 3rd. From there, the Polymarket seems to trend back towards favoring a no outcome, especially after the U.S.’s announcement of “reciprocal” tariffs on April 2nd. The average price of a yes share was approximately $0.30, indicating that the Polymarket was moderately certain that the tariffs would not be removed. In fact, the average price of a yes share in March was approximately $0.10, indicating that the Polymarket was already highly certain of a no outcome. As tariffs were ultimately not removed, this Polymarket was accurate in its prediction, and with high certainty, in contrast to the previous case.

Figure 3

Figure 3 shows the Polymarket “Which countries will Trump tariff in first 100 days? EU.” This market seems consistent in its prediction, with an overall average price of $0.71 for a yes share. The Polymarket did see the price of a yes share increase following Trump’s imposition of tariffs on Canada, China, and Mexico in March. Overall, this Polymarket was accurate in its prediction, and had moderate certainty of the outcome.

To expand the sample size, this analysis now examines several other cases. The Polymarket “Will Trump increase tariffs on Mexico before May?” had an overall yes share price of $0.16, highly certain of a no outcome. However, this prediction was inaccurate. The Polymarket “How large will Trump’s EU tariffs be?” predicted a tariff of 21% on average, which was accurate. The Polymarket “US-China trade deal before June” had an average yes share price of $0.37, moderately certain of a no outcome. This prediction was also inaccurate. The Polymarket “Will Trump impose large tariffs in his first 6 months” had an average yes share price of $0.61, moderately certain of a yes outcome, and was accurate in its prediction. The Polymarket “Will Trump remove tariff on Mexico before May” had an average yes share of $0.33, moderately certain of a no outcome. This prediction was accurate. Finally, the Polymarket “Will Trump remove tariffs on China before May” had an average yes share price of $0.07, near certain of a no outcome. This prediction was also accurate.

In total, six of the Polymarkets examined were found to have accurate predictions and three were inaccurate. However, for both the accurate and inaccurate prediction, certainty varied widely. Thus, while prediction markets can at times offer an accurate prediction of whether tariff rates will be imposed or held in place, they are unlikely to offer any insight that will ease the uncertainty of business owners or help them accurately plan for future circumstances.

Given the typical accuracy of prediction markets, this truly highlights the uncertainty over Trump’s tariffs present throughout the economy. That uncertainty, if continuous, could have devasting effects beyond the typical implications of tariffs.

You must be logged in to post a comment.